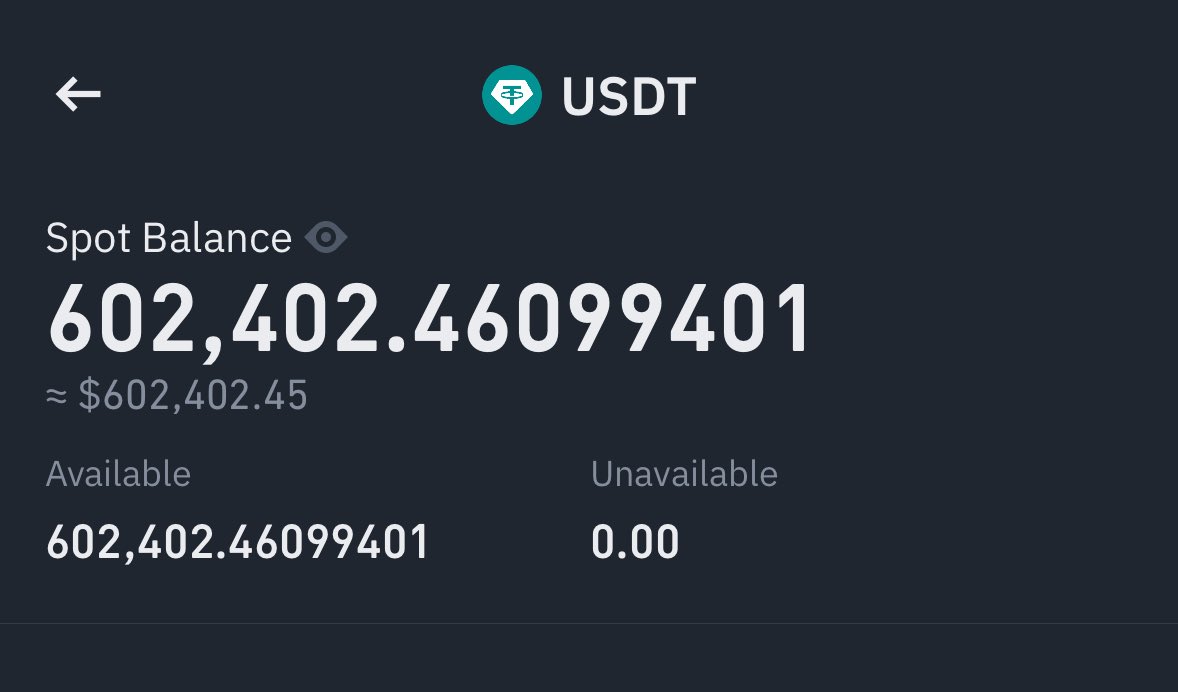

A cryptocurrency trader has lost roughly $600,000 worth of Tether after transferring funds to a fraudulent wallet address that closely resembled a legitimate one, highlighting a surge in so-called “address poisoning” attacks targeting digital asset users.

A cryptocurrency trader has lost roughly $600,000 worth of Tether after transferring funds to a fraudulent wallet address that closely resembled a legitimate one, highlighting a surge in so-called “address poisoning” attacks targeting digital asset users.Blockchain security analysts said the victim intended to move USDT to a trusted contact but instead copied and pasted a spoofed address from their transaction history. The malicious address shared the same beginning and ending characters as the genuine wallet, making the discrepancy difficult to detect at a glance. Once the transaction was confirmed on the blockchain, the funds were irretrievable.

Address poisoning exploits a common user habit in cryptocurrency transfers: verifying only the first and last few characters of a wallet address. Attackers send negligible amounts of cryptocurrency from a wallet engineered to mimic a known address. That counterfeit entry then appears in the victim’s transaction history. When the victim later copies what appears to be the correct address from that list, funds are sent to the attacker instead.

USDT, issued by Tether and widely used as a dollar-pegged stablecoin across networks such as Ethereum and Tron, has become a frequent target for such schemes due to its liquidity and near-instant settlement. Blockchain data indicates that stablecoins account for a significant share of transaction volume on public ledgers, making them attractive to scammers seeking large, swift transfers.

Cybersecurity firms tracking blockchain fraud say address poisoning incidents have multiplied over the past year as digital asset adoption broadens. Losses vary from a few thousand dollars to sums exceeding half a million dollars in individual cases. The pseudo-anonymous nature of most public blockchains complicates recovery efforts, although some funds have occasionally been frozen when issuers are alerted promptly.

Tether has the technical ability to blacklist specific wallet addresses holding USDT under certain circumstances, a measure it has used in cases linked to hacks and law enforcement actions. However, once funds are transferred and rapidly dispersed across multiple wallets or converted into other assets, the chances of recovery diminish sharply. Analysts note that speed is critical; the window for freezing funds can close within minutes if attackers move assets through decentralised exchanges or cross-chain bridges.

The incident underscores broader concerns about user-side security in decentralised finance. Unlike traditional banking systems, blockchain transactions cannot be reversed by a central authority. That design is a core feature of cryptocurrencies, intended to eliminate intermediaries, but it places full responsibility for address verification and transaction accuracy on users.

Exchanges and wallet providers have introduced safeguards aimed at reducing such risks. Some platforms now display full wallet addresses by default rather than truncating them. Others provide address whitelisting features, allowing users to approve specific destinations before enabling transfers. Hardware wallets and multi-signature arrangements are also promoted as protective tools, particularly for high-value holdings.

Regulators across several jurisdictions have increased scrutiny of crypto-related fraud as digital assets become more integrated into mainstream finance. Authorities in the United States, Europe and parts of Asia have issued warnings about phishing, impersonation and address spoofing techniques. Enforcement actions have targeted organised fraud networks, though cross-border coordination remains complex given the global reach of blockchain transactions.

Industry participants argue that education is as important as enforcement. Security specialists recommend verifying entire wallet strings, conducting small test transactions before large transfers, and avoiding copying addresses from transaction histories without cross-checking against trusted records. They also advise users to be cautious of unsolicited micro-transfers, which can signal an attempt at poisoning.

Data from blockchain analytics groups shows that while total crypto-related crime fluctuates with market cycles, scams and social engineering attacks continue to account for a substantial share of illicit activity. Stablecoins, because they maintain a consistent value and are widely accepted across trading platforms, are particularly attractive for settlement in fraudulent schemes.

Topics

Cryptocurrency