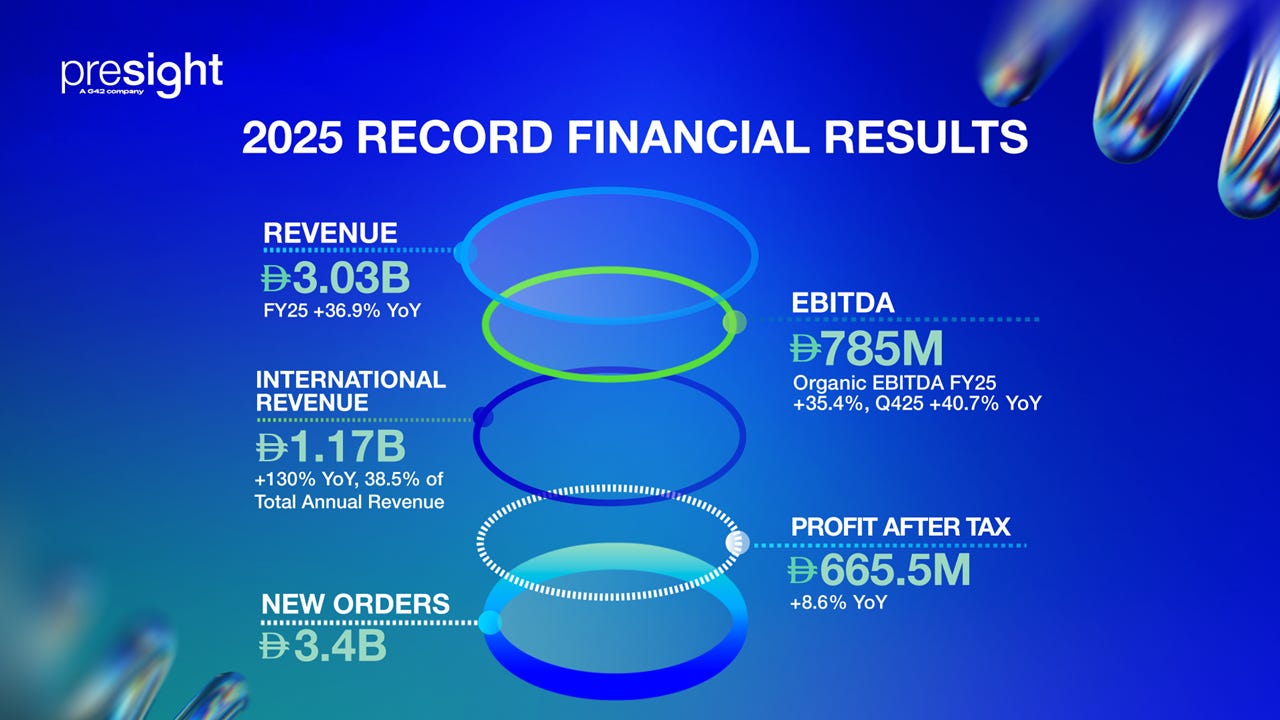

Presight has reported a sharp rise in annual earnings, posting revenue of AED3.03 billion for the year ended 31 December 2025, a 36.9 per cent increase on the previous year, as demand for data analytics and artificial intelligence services gathered pace across public and private sectors.

Presight has reported a sharp rise in annual earnings, posting revenue of AED3.03 billion for the year ended 31 December 2025, a 36.9 per cent increase on the previous year, as demand for data analytics and artificial intelligence services gathered pace across public and private sectors.The Abu Dhabi-based technology company said revenue growth was driven by a broad expansion of contracts across government, energy, financial services and smart city projects, reflecting accelerating digital transformation programmes in the Gulf and beyond. The latest figures translate to more than $817 million in annual revenue, marking one of the strongest performances since its listing on the Abu Dhabi Securities Exchange.

Chief executive Thomas Pramotedham described the performance as evidence of “strong execution against a diversified backlog” and highlighted the company’s ability to convert long-term framework agreements into billable deployments. Management indicated that operating profit and net income also rose in line with revenue growth, supported by improved utilisation rates and a disciplined cost structure.

Presight, a subsidiary of technology group G42, has positioned itself as a regional leader in applied artificial intelligence, offering predictive analytics, geospatial intelligence and digital twin solutions. The company’s model centres on large-scale government and enterprise contracts, often structured over several years. Analysts note that this approach provides revenue visibility but can also expose earnings to the timing of project roll-outs and milestone payments.

The latest results come against a backdrop of significant AI investment across the Gulf. Governments in Abu Dhabi, Dubai and Riyadh have intensified spending on data-driven governance, cybersecurity and infrastructure optimisation. Presight has been a beneficiary of this trend, securing projects related to public safety, transportation analytics and energy efficiency. Industry observers say the firm’s integration with G42’s broader AI ecosystem, including cloud infrastructure and advanced computing resources, has strengthened its competitive position.

Financial disclosures show that backlog remains robust, giving management confidence in forward revenue guidance. The company has not detailed individual contract values but indicated that pipeline opportunities remain strong in both domestic and international markets. Presight has previously expanded into Central Asia and Africa, targeting markets seeking turnkey AI solutions without building extensive in-house capabilities.

Market reaction to the results was measured, with shares trading within a narrow range following the announcement. Equity analysts have largely maintained constructive outlooks, citing the company’s growth trajectory and the structural expansion of AI adoption. However, some have cautioned that margins could face pressure as competition intensifies and governments push for cost efficiencies.

The technology sector in the Emirates has undergone rapid evolution over the past five years, with state-backed entities investing heavily in AI infrastructure, cloud services and semiconductor partnerships. Presight’s strategy aligns with national ambitions to embed artificial intelligence across healthcare, mobility and security. Executives have reiterated their commitment to research and development spending, focusing on proprietary platforms that integrate data analytics with operational technology.

Comparative figures indicate that Presight’s revenue growth outpaced many regional technology peers, reflecting both organic expansion and scaling of earlier contracts. Global AI spending has continued to rise, with enterprise budgets increasingly allocated to automation, predictive maintenance and advanced analytics. Consultancy projections suggest sustained double-digit growth in AI services worldwide through the end of the decade, driven by regulatory compliance requirements and efficiency gains.

Within the Emirates, digital transformation has been underpinned by regulatory reforms encouraging data governance and cybersecurity resilience. Presight has emphasised compliance frameworks and ethical AI deployment as core elements of its value proposition. Management has highlighted the importance of transparent algorithms and secure data handling, particularly in public-sector deployments where privacy considerations are paramount.

Industry analysts say Presight’s performance also reflects a shift in procurement patterns. Governments and large corporations are moving from pilot AI initiatives to full-scale operational integration. This transition tends to increase contract sizes and deepen vendor relationships, though it also requires sustained capital expenditure and skilled workforce development.

The company’s capital structure remains stable, with manageable leverage levels and positive cash flow generation supporting investment plans. Presight has not announced dividend changes but signalled continued reinvestment into platform development and geographic expansion. Observers note that balancing shareholder returns with growth funding will remain a strategic consideration as competition in AI services intensifies.

Regional technology champions have faced scrutiny over valuations and execution risk. Presight’s ability to convert pipeline contracts into realised revenue has been closely watched since its market debut. The latest figures suggest consistent momentum, though investors remain attentive to macroeconomic factors, including energy prices and public-sector budget allocations, which can influence technology spending cycles.

Topics

Spotlight