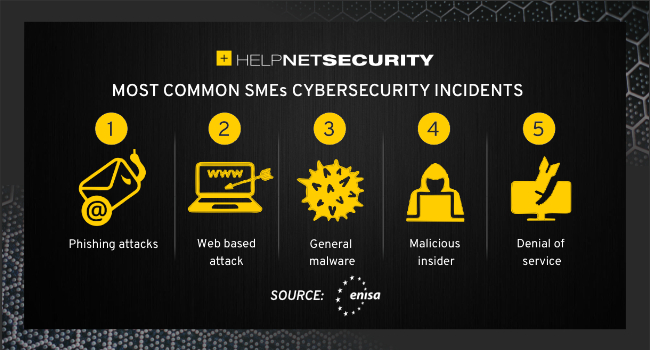

Speakers walked attendees through the evolving landscape of cyber threats that SMEs are increasingly exposed to: phishing schemes, ransomware, weak authentication protocols, and business email compromise. Demonstrations included advanced detection tools, best practice guidelines for response and recovery, and strategies to anticipate threats before they escalate.

Faisal Al-Gharabally, General Manager of International Banking at Gulf Bank, opened the seminar by emphasising the need for clients to grasp “essential steps to secure their digital safety and protect their businesses from cyber risks.” He described the partnership with CrowdStrike as a “successful model of effective collaboration that supports national development goals and shields the local economy and startups from rising digital threats.”

Ross McNaughton, Chief Information Security Officer at Gulf Bank, reinforced that cybersecurity protection must extend beyond the bank itself. “By helping them enhance their security, we protect their investments and contribute to safeguarding Kuwait’s business ecosystem from cyber threats. This is an integral part of our social responsibility,” he said.

The Diraya campaign, launched by the Central Bank of Kuwait in partnership with the Kuwait Banking Association, frames much of the banking sector’s awareness drive. Gulf Bank is placing focus on building capacity among SMEs in particular through educational initiatives and deploying tools that enable better monitoring, risk assessment and response.

Technology showcased at the seminar included real-time threat monitoring dashboards, tailored endpoint protection solutions, and incident-response planning kits. Gulf Bank and CrowdStrike stressed that these tools must be coupled with regular training, robust governance and ongoing audits, especially for businesses where cybersecurity has been under-invested.

Topics

Technology