Under the deals, AD Ports will allocate up to AED 1.3 billion to site infrastructure such as dredging and jetty development, while Nimex will invest up to AED 2.6 billion in cryogenic storage tanks, pipelines, loading arms and related superstructure.

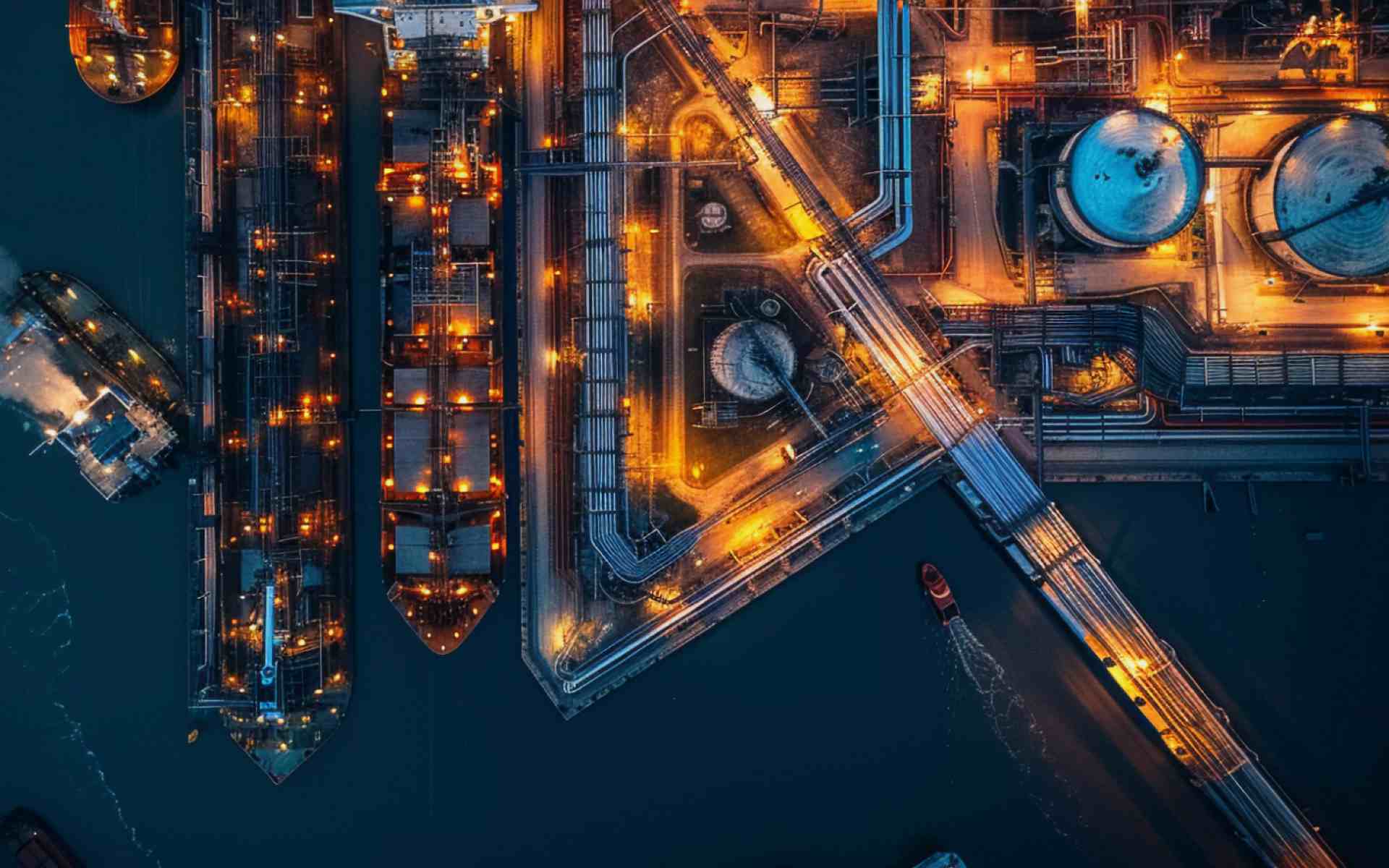

The terminal development is planned over a five-year period. The LNG module will occupy around 130,000 m² and support 400,000 m³ of storage, while the LPG component spans 90,000 m² and will reach 280,000 m³ at full build-out.

AD Ports says the hubs will serve import, export and trans-shipment demands, particularly targeting growth in Asia’s gas market. The location at Khalifa Port offers multimodal connectivity by sea, land, air and rail, in proximity to the Khalifa Economic Zones–Abu Dhabi free-zone network.

Capt Mohamed Juma Al Shamisi, Managing Director and Group CEO of AD Ports, described the agreements as a “transformative milestone for Khalifa Port and the UAE’s energy sector”, adding that the partnership will equip the port with lower-impact fuel infrastructure and bolster its role in the global shipping industry.

Azmat Mahmood, Executive Chairman of Nimex Terminals, said the investments will enhance the port’s attractiveness and reaffirm commitment to advanced low-emission fuel technologies while supporting sustainable economic growth.

The move comes as shipping and logistics firms increasingly pivot to alternative fuels such as LNG and LPG in response to decarbonisation pressures and tighter emissions regulation. Industry observers note that enabling large long-haul gas carriers to dock and trans-ship through a regional hub aligns with broader strategic ambitions to make the UAE a major clean-fuel logistics centre.

Khalifa Port has been advancing in global rankings and this deal strengthens its footprint: it is currently ranked 39th on the Lloyd’s List Top 100 Container Ports list for 2025.

While the headline value is AED 30 + billion, analysts caution that not all of the capital will be deployed immediately. The phased construction means much of the outlay will follow operational milestones and market conditions. Further, steeper demand for LNG and LPG infrastructure will depend on global gas market dynamics, macro-economic sentiment and shipping-industry regulations.

From a strategic-risk viewpoint, the terminal developments carry exposure to fluctuations in mid- to long-haul gas carrier demand and to potential shifts in fuel-transition technologies which may influence usage patterns. The companies have noted the deal is based on projected 50-year multiple-revenue streams from the terminals.

Beyond infrastructure, the joint venture is expected to support job creation, foreign direct investment and growth of ancillary services in shipping, logistics and energy. It aligns with the UAE’s target of its net-zero by 2050 strategy.

Financial-markets watchers point to implications for AD Ports’ listed entity. The announcement may bolster investor sentiment around its diversification into energy-logistics infrastructure beyond traditional container operations, yet questions remain around execution risk, potential cost overruns and the demand curve for gas-carrier port services.

Topics

UAE