The oil-rich Middle East, accustomed to outpacing global trends in wealth creation, witnessed a significant slowdown in 2023. According to the Capgemini Research Institute's World Wealth Report 2024, the region's high-net-worth individual (HNWI) wealth rose by a meager 2. 9% year-on-year, a stark contrast to the global average of 4. 7%. This sluggish growth extends to the HNWI population itself, which only expanded by 2. 1% compared to the global increase of 5. 1%.

The report attributes this muted performance to a confluence of factors. The primary culprit is the decline in oil prices, a vital economic driver for many Middle Eastern countries. Weakened demand for OPEC crude coupled with ongoing supply chain disruptions dampened the region's financial prospects. Further complicating matters were the geopolitical tensions stemming from the Israel-Gaza conflict, which exacerbated supply chain vulnerabilities and instilled a degree of economic uncertainty.

Despite the slowdown, the Middle East's HNWI wealth still managed to reach new heights, albeit at a slower pace. The total wealth held by the region's HNWIs surpassed the $2 trillion mark in 2023. This indicates that the underlying fundamentals of the region's economy remain robust, but require a period of recalibration in the face of the new global economic climate.

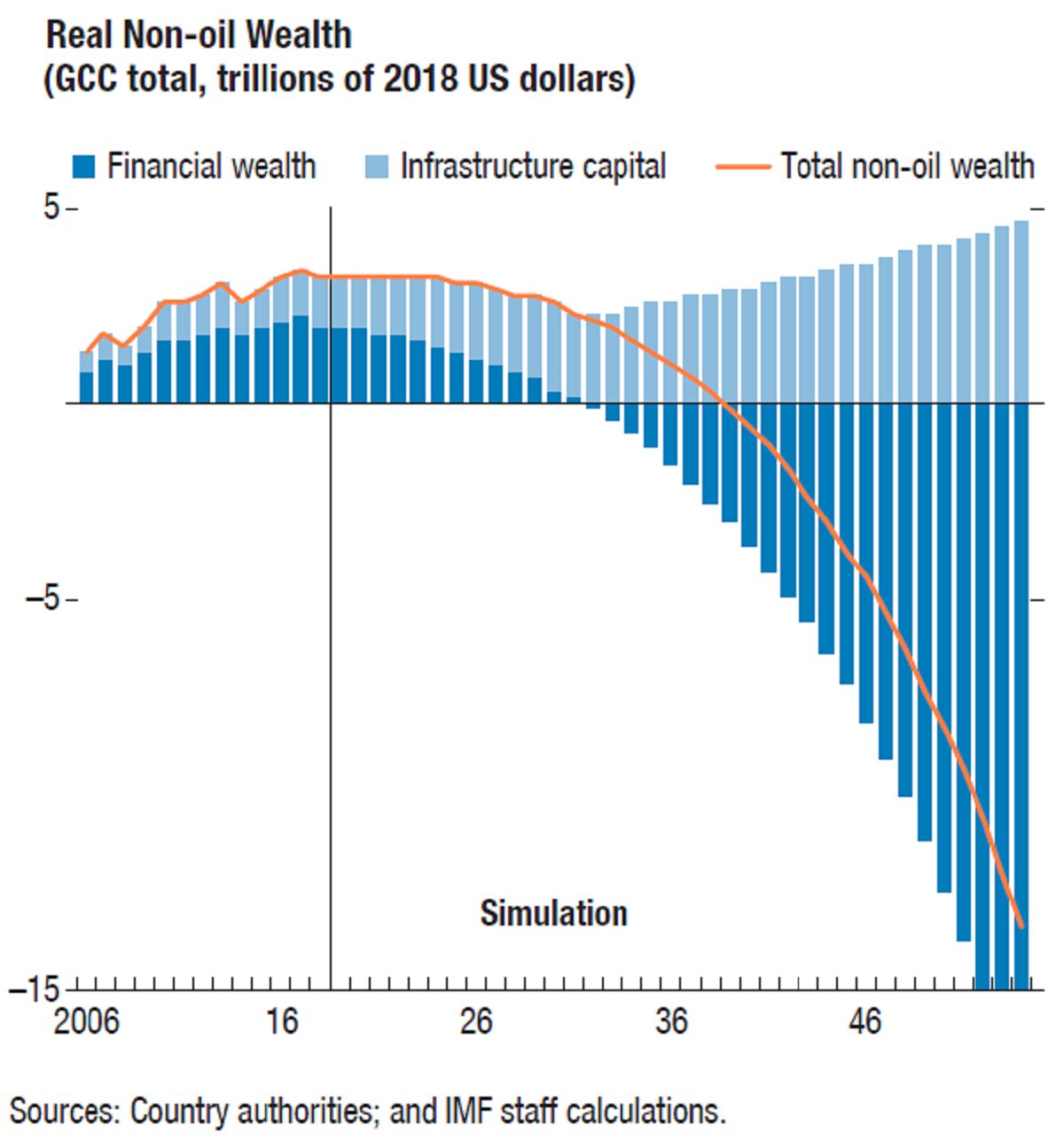

On the flip side, the slowdown presents an opportunity for diversification. With oil revenues no longer surging at the historical pace, Middle Eastern countries are actively pursuing economic diversification strategies. Investments in infrastructure, technology, and renewable energy are on the rise, with a view towards building a more resilient and future-proof economy.

The report also highlights pockets of resilience within the region. While the broader Middle East witnessed a slowdown, some countries, like Saudi Arabia, managed to outperform regional averages. This can be partially attributed to the kingdom's ongoing economic reforms and its ambitious Vision 2030 plan, which aims to lessen the nation's dependence on oil.

Looking ahead, the future trajectory of wealth creation in the Middle East hinges on several key factors. The global oil price recovery and the effectiveness of diversification efforts will be crucial determinants. Additionally, geopolitical stability and fostering a business-friendly environment will be essential to attract and retain investments.

While the short-term outlook for the Middle East's HNWI population and wealth growth may be tempered, the region possesses the necessary resources and strategic vision to navigate these challenges and reignite its economic dynamism.