The International Monetary Fund (IMF) has dealt a blow to the economic optimism of the Middle East and North Africa (MENA) region. Citing geopolitical tensions and disruptions to international trade as major hurdles, the IMF revised its 2024 growth forecast for the region downwards by 0.5 percentage points to 2.9%. This comes after a year of sluggish growth of just 2.0% in 2023.

The ongoing conflict between Israel and Gaza is a significant factor dampening the region's economic prospects. The IMF estimates that the West Bank and Gaza economies contracted by a staggering 6% in 2023, a much sharper decline than the 9% drop predicted earlier. Neighboring countries like Egypt, Jordan, and Lebanon are also expected to face a challenging economic climate due to the conflict's ripple effects.

Beyond the immediate conflict, the broader geopolitical landscape is casting a long shadow. The war in Ukraine continues to disrupt global supply chains and drive up the prices of essential commodities. This is having a knock-on effect on the MENA region, which relies heavily on imports for a variety of goods. Investor confidence has also been shaken by the global uncertainty, making it harder for MENA countries to attract investment.

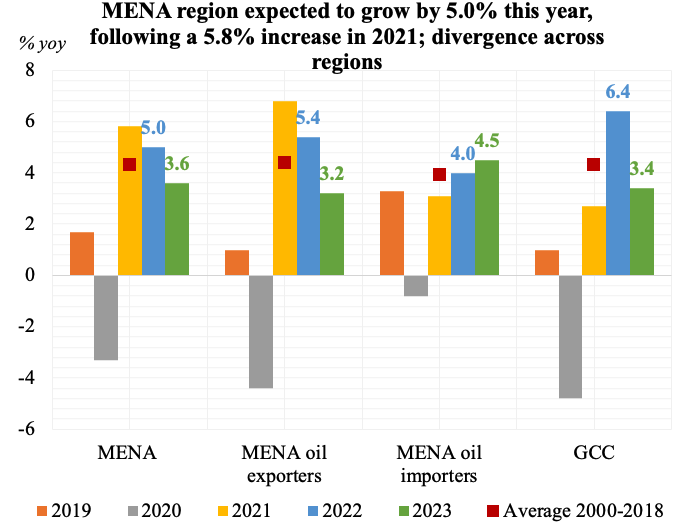

The IMF's report acknowledges that some pockets of the region are showing signs of resilience. Oil exporters have benefited from the surge in oil prices triggered by the war in Ukraine. However, this windfall is unlikely to be enough to offset the overall slowdown. Additionally, some countries in Central Asia, which are less reliant on oil exports, are projected to maintain robust growth due to strong domestic demand.

The downward revision in the IMF's forecast serves as a stark reminder of the region's vulnerability to external shocks. To navigate these choppy economic waters, the IMF recommends that policymakers prioritize strengthening their economic fundamentals. This includes implementing reforms to improve governance and attract investment, as well as building up fiscal buffers to weather future storms.

Countries in the MENA region must also look for ways to diversify their economies and reduce their dependence on oil exports. This will make them less susceptible to price fluctuations in the global oil market. Investing in renewable energy sources and promoting the growth of non-oil sectors like tourism and manufacturing are crucial steps in this direction.

The path to a more robust and resilient MENA economy will require a combination of sound economic policies, regional cooperation, and a de-escalation of geopolitical tensions. The coming months will be a critical test for the region's ability to weather the storm and unlock its full economic potential.