Australian consumer prices rose at their fastest pace in five months in April, according to data released by the Australian Bureau of Statistics (ABS) on Wednesday. The Consumer Price Index (CPI) climbed 3. 6% year-on-year in April, exceeding market expectations of 3. 4% and up from 3. 5% in March.

The rise in inflation was fueled by a number of factors, including surging petrol prices, rising healthcare costs, and the impact of Easter holiday travel. The cost of gasoline jumped 9. 5% in the year to April, reflecting global oil price volatility caused by the war in Ukraine. Healthcare costs also grew significantly, with a 2. 4% increase compared to April 2023. This increase was attributed to rising prices for pharmaceuticals and medical services.

The Easter holiday period also played a role in pushing up prices for some goods and services. Accommodation prices rose sharply, reflecting increased travel demand during the holidays. Prices for recreational activities and other holiday-related expenses also climbed.

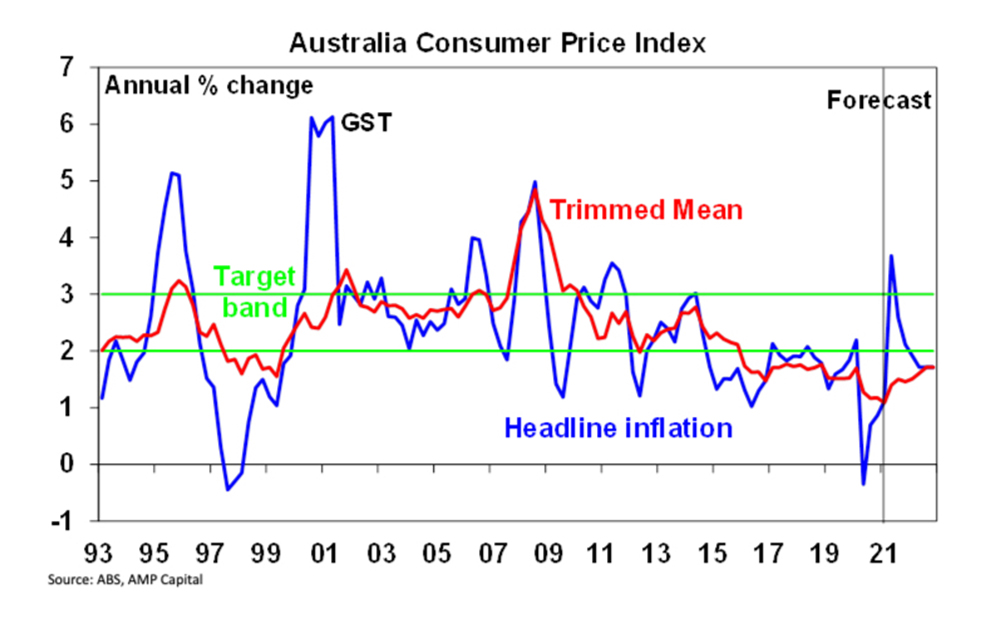

The rise in inflation has put pressure on the Reserve Bank of Australia (RBA) to consider raising interest rates. The RBA has a target inflation rate of between 2% and 3%, and the April figure is well above that range. Higher interest rates are seen as a tool to cool inflation by dampening economic activity and consumer spending.

The ABS data also showed that core inflation, which excludes volatile items like fresh food and petrol, rose to 4. 1% in April, up from 4% in March. This indicates that underlying inflationary pressures are also building in the Australian economy.

The surge in inflation is likely to weigh on Australian households, as it erodes purchasing power and reduces real wages. Consumers are already feeling the pinch of higher prices at the grocery store and the gas pump. The impact is likely to be most pronounced for low-income households, who spend a larger proportion of their income on essential goods and services.

The Australian government is facing increasing pressure to address the rising cost of living. The government has argued that some of the inflationary pressures are due to global factors beyond its control. However, it is also facing calls to take steps to ease cost pressures, such as by increasing welfare payments or reducing taxes.

The RBA is expected to closely monitor inflation data in the coming months. The May meeting of the RBA's board will be closely watched by financial markets, with investors eager to see if the central bank raises interest rates. A rate hike would be the first since 2010 and could have a significant impact on the Australian economy.